Property taxes are one of the most common sources of confusion for homeowners and buyers moving to North Atlanta. In Forsyth County—one of Georgia’s fastest-growing counties—understanding how property taxes are calculated can help you plan better, avoid surprises, and make smarter housing decisions.

This guide explains how Forsyth County property taxes work in 2026, how bills are calculated, when payments are due, and what homeowners in Cumming and surrounding areas should watch for.

What Property Taxes Pay For in Forsyth County

Property taxes fund local public services. In Forsyth County, these typically include:

- Public schools (Forsyth County Schools)

- Police, fire, and emergency services

- Roads, parks, and libraries

- County administration and infrastructure

Your tax bill is not a single charge—it’s a combination of county, school, and sometimes city taxes.

Who Sets Property Values?

Property values are assessed by the Forsyth County Board of Assessors, not by real estate agents or lenders.

Each property is assigned a fair market value, based on factors such as:

- Recent home sales in your area

- Property size, condition, and features

- Location and neighborhood trends

Georgia law requires reassessments annually, though not every home’s value changes every year.

Assessed Value vs. Market Value (The 40% Rule)

Georgia uses a standardized formula:

- Assessed Value = 40% of Fair Market Value

For example:

If your home’s market value is $500,000 → assessed value is $200,000.

This assessed value is what local millage rates are applied to.

What Is a Millage Rate?

A millage rate is the tax rate used by local governments.

- One mill = $1 in tax per $1,000 of assessed value

Your total tax bill is calculated by adding together millage rates from:

- Forsyth County government

- Forsyth County Schools

- City taxes (if you live within city limits, such as Cumming)

Millage rates are approved annually and can change year to year.

Why School Taxes Are the Largest Portion

For most homeowners, school taxes make up the biggest share of the property tax bill.

Even residents without children contribute to school funding, which helps explain why Forsyth County taxes may be higher than in some neighboring counties—high-performing schools require sustained funding.

Homestead Exemptions: The Most Important Tax Break

If the home is your primary residence, you should apply for a homestead exemption.

Benefits include:

- Lower taxable value

- Protection from sharp assessment increases (depending on exemption type)

Forsyth County offers several exemptions, including:

- Basic homestead exemption

- Senior exemptions

- Disability-related exemptions

You must apply—it is not automatic.

Forsyth County Property Tax Example

Home market value: $550,000

Step 1 – Apply Georgia’s 40% assessment rule

$550,000 × 40% = $220,000 (assessed value)

Step 2 – Apply typical Forsyth County millage rates

Assume a combined county + school millage rate of 24 mills

(24 mills = $24 per $1,000 of assessed value)

Step 3 – Calculate the annual tax

$220,000 ÷ 1,000 = 220

220 × $24 = $5,280 per year

If the home qualifies for a homestead exemption

Assume a $30,000 exemption:

$220,000 − $30,000 = $190,000 taxable value

$190,000 ÷ 1,000 = 190

190 × $24 = $4,560 per year

What this shows

Homestead exemptions can reduce the bill by hundreds of dollars each year

You are not taxed on the full $550,000

The tax is based on 40% of the value

When Are Property Tax Bills Due?

In Forsyth County:

- Tax bills are typically mailed in late summer or early fall

- Payment is usually due by October 15

Late payments may result in penalties or interest, so it’s important to watch for the notice.

What Happens If Your Home Value Jumps?

Rapid growth in North Atlanta has caused noticeable value increases in some neighborhoods.

If you believe your assessment is too high, you can:

- File an appeal during the official appeal window

- Provide comparable sales or documentation

- Request a review or hearing

Many homeowners successfully reduce their assessed value by appealing, especially after unusually strong market years.

Buying a Home Mid-Year: How Taxes Are Handled

If you purchase a home mid-year:

- Property taxes are typically prorated at closing

- Your first full tax bill will arrive the following year

- Homestead exemptions must be applied for after purchase

This is especially relevant for buyers relocating from lower-tax counties or from out of state.

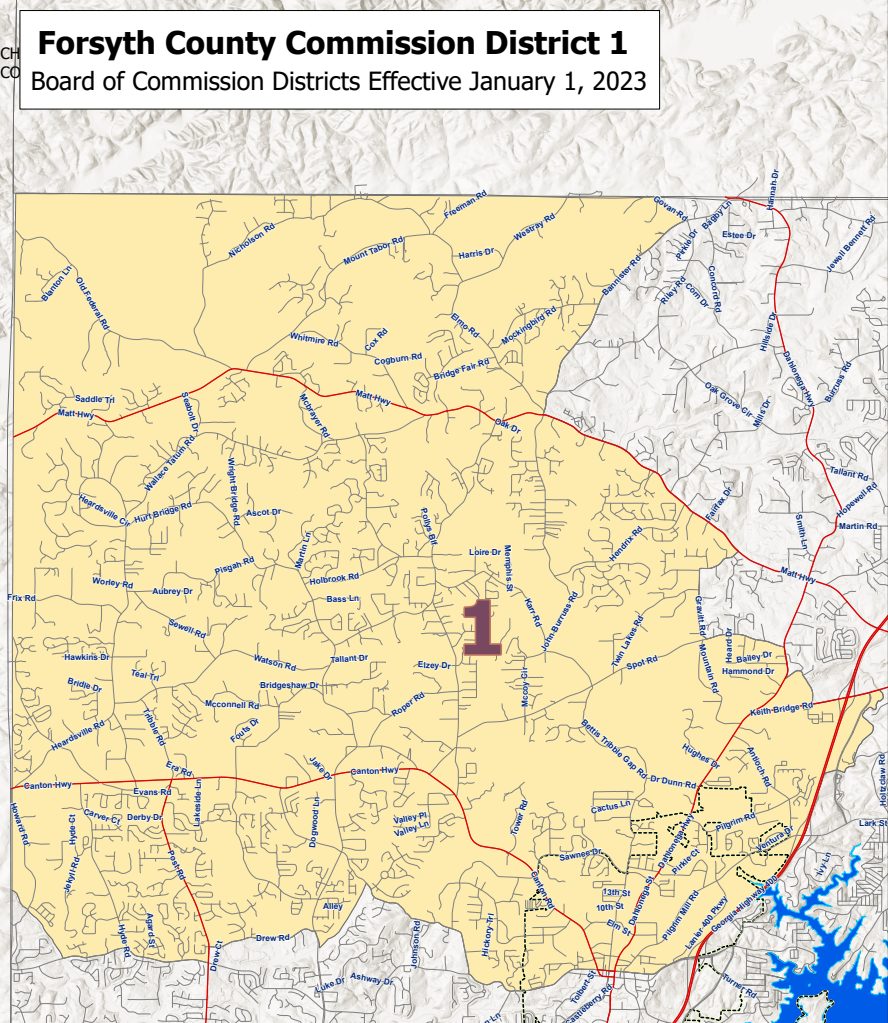

City vs. Unincorporated Forsyth County

Not all Forsyth County residents pay the same taxes.

- Homes inside the City of Cumming pay city taxes in addition to county and school taxes

- Homes in unincorporated areas pay county and school taxes only

This difference can be meaningful when comparing otherwise similar homes.

Planning Ahead as a Homeowner

To avoid surprises:

- Check assessed values annually

- Apply for exemptions as soon as eligible

- Budget for gradual increases rather than flat bills

- Understand that new construction often triggers reassessment

Property taxes are a long-term cost of ownership, not a one-time fee.

Why This Matters for North Atlanta Residents

Forsyth County’s growth, schools, and infrastructure continue to attract new residents. Knowing how property taxes work helps you evaluate affordability more accurately—especially when comparing homes across Cumming, Alpharetta, and nearby areas.

Comparing Counties?

Property taxes can vary significantly across North Atlanta. If you’re choosing between Forsyth, Fulton, and Gwinnett counties, see our full Forsyth vs. Fulton vs. Gwinnett property tax comparison.

Get a free Forsyth County property tax estimate

Property taxes in Forsyth County can vary by city limits, school district, and available exemptions. If you’re buying, owning, or investing, we can estimate a realistic tax range for the area you’re considering.

- No pressure, local insight

- Helpful for buyers, homeowners, and investors

- Clear expectations before you commit

Estimates are informational and not an official tax bill.