Homebuyers moving around North Atlanta often notice that two similar homes can come with very different property tax bills—depending entirely on the county line they fall on.

This guide compares property taxes in Forsyth, Fulton, and Gwinnett counties as of 2026, focusing on how taxes are calculated, what typically drives higher bills, and which areas tend to be more predictable for long-term homeowners.

The Big Picture: What All Three Counties Have in Common

Across Georgia, property taxes follow the same basic structure:

- Homes are assessed at 40% of fair market value

- Taxes are based on millage rates set by counties, school districts, and cities

- Bills usually arrive once per year (late summer or fall)

- Homestead exemptions reduce taxable value for primary residences

The differences come from school funding levels, county services, and city taxes.

Forsyth County: Newer Homes, Strong Schools, Steady Increases

Forsyth County is known for rapid growth, newer developments, and consistently high-performing schools.

What to Expect

- School taxes make up the largest portion of the bill

- Home values often rise faster due to demand

- Annual reassessments are common in newer neighborhoods

Typical Homeowner Profile

- Families prioritizing school quality

- Buyers in master-planned or newly built communities

- Residents in or near Cumming

Tax Feel (Relative)

- Not the cheapest, but predictable

- Bills tend to rise gradually rather than jump unexpectedly

For a deeper look at how assessments, exemptions, and billing work locally, see our full Forsyth County property tax guide.

Fulton County: Wide Range, Higher Ceiling

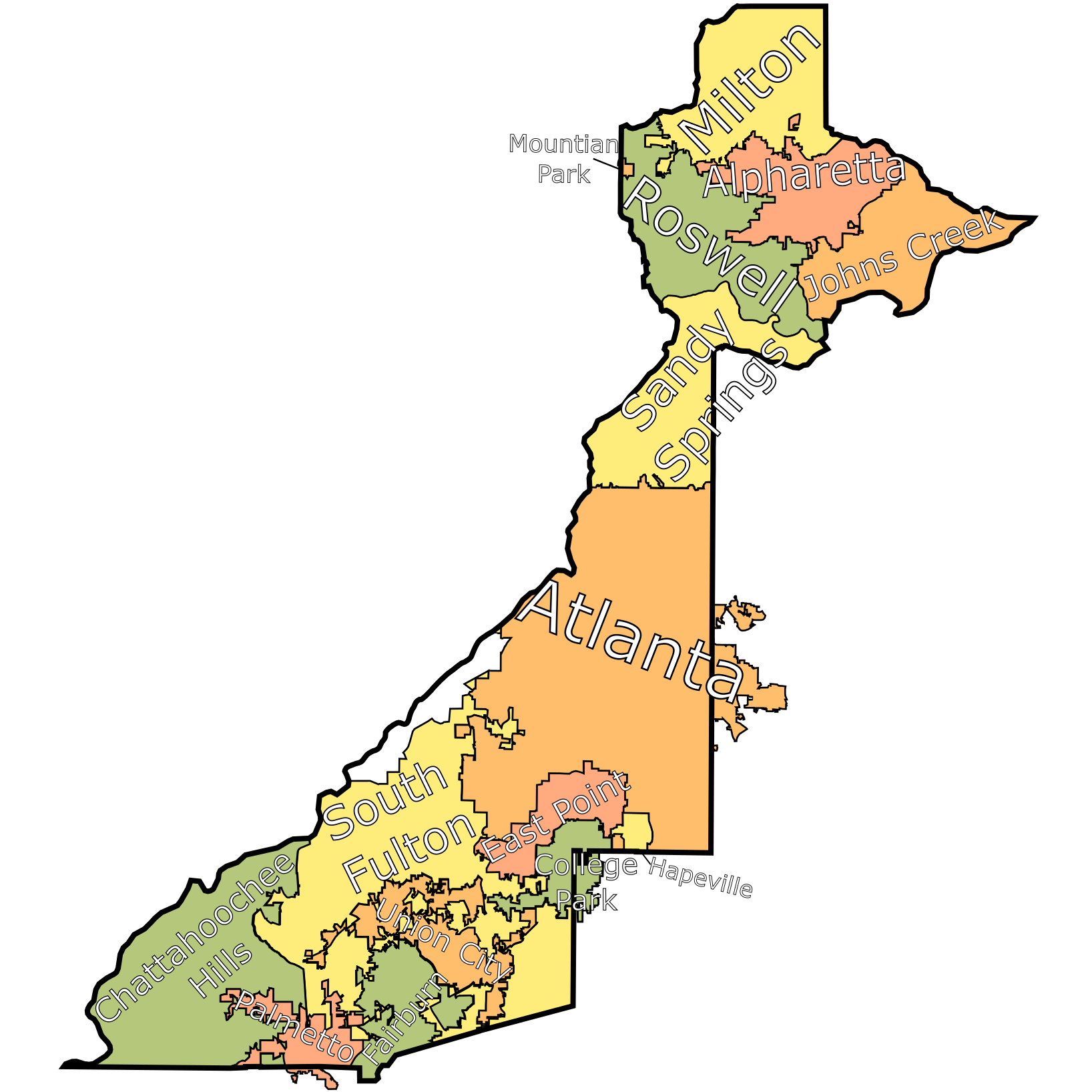

Fulton County is the most complex of the three. Taxes vary dramatically depending on whether a home is in Atlanta, a smaller city, or unincorporated areas.

What to Expect

- City taxes can significantly increase bills

- Millage rates are often higher than neighboring counties

- Appeals are common due to sharp valuation changes

Typical Homeowner Profile

- Buyers in Alpharetta, Milton, Roswell, or Atlanta

- Condo and townhome owners in incorporated cities

- Residents trading location for higher tax costs

Tax Feel (Relative)

- Highest potential tax burden

- Most variation from one neighborhood to another

Gwinnett County: Larger Base, Moderate Rates

Gwinnett County balances a large population with a broad tax base, which can help stabilize rates.

What to Expect

- Generally moderate millage rates

- Fewer extreme year-to-year swings

- School taxes still dominate, but spread across more residents

Typical Homeowner Profile

- Buyers seeking value and diversity

- Families in Johns Creek, Duluth, or Suwanee

- Long-term homeowners looking for consistency

Tax Feel (Relative)

- Often middle-of-the-road

- Fewer surprises compared to Fulton

Side-by-Side Snapshot (High-Level)

| Factor | Forsyth | Fulton | Gwinnett |

|---|---|---|---|

| School Tax Impact | High | High | High |

| City Taxes | Limited | Common | Common |

| Bill Predictability | High | Low–Medium | Medium–High |

| Appeals Frequency | Moderate | High | Moderate |

| New Construction Effect | Strong | Moderate | Moderate |

Why Two Similar Homes Can Have Different Tax Bills

A $600,000 home can generate very different taxes based on:

- County millage rates

- Whether the home is inside city limits

- School district funding

- Homestead exemption status

This is why buyers comparing homes in Forsyth vs. Fulton—or Johns Creek vs. Alpharetta—should always look beyond list price.

Which County Is “Best” for Property Taxes?

There’s no universal winner—only trade-offs.

- Forsyth County favors predictability and schools

- Fulton County offers location but at a higher cost ceiling

- Gwinnett County provides balance and broader affordability

For many North Atlanta buyers, the deciding factor is not taxes alone, but how taxes align with schools, commute, and long-term plans.

Smart Tips Before You Buy

- Ask for the previous year’s tax bill, not estimates

- Confirm whether the home qualifies for a homestead exemption

- Check if city taxes apply

- Budget for reassessments after purchase

- Understand that new construction is often reassessed upward

Why This Comparison Matters in North Atlanta

County lines in North Atlanta can sit just minutes apart—but the financial impact lasts for years. Understanding how Forsyth, Fulton, and Gwinnett differ helps buyers make informed decisions instead of reacting to their first tax bill.

Get a free Forsyth County property tax estimate

Property taxes in Forsyth County can vary by city limits, school district, and available exemptions. If you’re buying, owning, or investing, we can estimate a realistic tax range for the area you’re considering.

- No pressure, local insight

- Helpful for buyers, homeowners, and investors

- Clear expectations before you commit

Estimates are informational and not an official tax bill.