In North Atlanta, “same ZIP” does not always mean “same property tax bill.” Two homes that look similar on paper can land in different tax districts depending on whether they’re inside city limits, in an unincorporated area, or in a special service district. That one detail can change the millage rates applied to your home’s assessed value—and the difference can add up year after year.

This guide explains what “city limits” really means for property taxes in North Atlanta suburbs—especially around Alpharetta, Milton, Roswell, Johns Creek, Duluth, Suwanee, and Cumming—so you can budget realistically before you buy.

Why city limits matter more than most buyers expect

Georgia property taxes generally follow the same structure statewide: counties determine a fair market value, property is assessed at 40% of that value, and then multiple taxing authorities apply millage rates to calculate your bill.

What changes from one address to the next is the taxing “stack”:

- County taxes (operations, bonds, and in some places service districts)

- School district taxes (often the largest share)

- City taxes (only if you’re inside a municipality that levies them)

- Special districts (in some areas, specific services can add separate millage)

So when a listing says “Alpharetta” or “Johns Creek,” that may be a mailing address or a general area name—not a guarantee the home is inside city limits. That’s why one neighborhood can feel “just down the road” from another, but carry a different tax profile.

City vs. unincorporated: what changes on your tax bill

1) City millage can add a second layer of taxes

In Georgia, municipalities can levy property taxes on the county-assessed value, based on city millage rates set by the city government.

Translation: If you’re inside city limits, you’re usually paying county + school + city (and sometimes more). If you’re outside city limits, you may pay county + school (plus any applicable service districts), but not the city portion.

Not every city levies the same amount. Some cities keep property taxes relatively low, and some may fund more services through property taxes. In Gwinnett, for example, the Tax Commissioner’s office explains that your total bill often includes county, schools, bonds, and cities where applicable.

2) Services may shift between city and county

Taxes aren’t just numbers—they’re tied to what governments provide. Inside city limits, your city may fund (or partially fund) things like planning, parks, code enforcement, police services, or city facilities. Outside city limits, the county may carry more of that load. This is one reason why city vs. county tax differences can persist even when homes are similar.

3) “One mill” isn’t one dollar of home value

Millage is applied to assessed value, not fair market value. One mill equals $1 per $1,000 of assessed value.

Because assessed value is typically 40% of market value, a small millage difference can still become meaningful over time—especially as valuations change.

North Atlanta examples: where city limits confusion happens

Here are common “buyer surprise” patterns in North Atlanta suburbs:

Alpharetta vs. “Alpharetta” mailing addresses

Some properties that show “Alpharetta” in listings or mail may actually be in unincorporated areas or near city edges. That can mean no city millage—or it can mean you’re in a different city’s jurisdiction, depending on the exact boundary.

Johns Creek / Duluth / Suwanee borders

In parts of north Fulton and western Gwinnett, neighborhoods can sit close to multiple city boundaries. That can create situations where one subdivision pays city taxes and a similar nearby one does not—or pays a different city’s rate.

Roswell and Milton “edge zones”

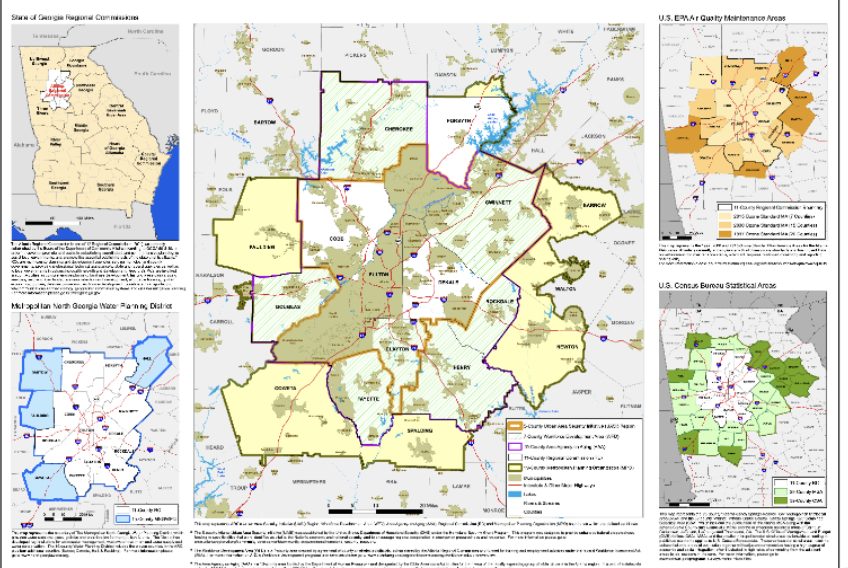

Fulton County is especially known for variation because it includes multiple cities plus unincorporated areas. That’s why buyers often see wide swings in property tax bills across short distances in north Fulton. For a county-level view, see our internal comparison guide: Forsyth vs. Fulton vs. Gwinnett property tax comparison (2026)

Cumming vs. unincorporated Forsyth

Forsyth County has large unincorporated areas where county + school taxes dominate. If you’re comparing homes “near Cumming,” make sure you confirm whether the property is inside Cumming city limits or simply nearby. Related: How property taxes work in Forsyth County (2026)

How to check city limits before you buy

If you take only one action from this article, make it this: verify jurisdiction using official mapping tools, not just the listing headline.

Step 1: Use the county GIS property viewer

Most metro counties provide an official property map viewer where you can search by address and see jurisdictions tied to the parcel.

- Fulton County: Use the Fulton County GIS Property Map Viewer and Fulton’s map/locator page.

- Forsyth County: Forsyth County provides GIS resources and open data tools through its GIS department and ArcGIS portal.

- Gwinnett County: If you’re estimating bill components, Gwinnett’s Tax Commissioner has billing and millage explanations (including city components where applicable).

Step 2: Look for “tax district” or jurisdiction fields

Many property records show fields that indicate whether a parcel is inside a municipality, plus the tax district that determines the millage stack. Georgia’s Department of Revenue explains that tax digest summaries are separated by tax district and show assessed totals and millage rates by district.

Step 3: Confirm with a second source if it’s close to a boundary

When a home sits near a border, confirm using a second official tool. For City of Atlanta addresses, the city’s GIS site includes a city-limits lookup tool.

Practical tip: If the boundary looks close, ask the listing agent for the prior year tax bill and whether city taxes apply. You’re not being difficult—you’re doing basic due diligence.

What to ask for: the 5-question buyer checklist

Before you make an offer, ask for these items (or look them up):

- Last year’s property tax bill (not a guess, not an average)

- Is the home inside city limits? If yes, which city?

- Does the bill include special districts? (Some areas include service district millage.)

- Does the current owner have a homestead exemption? Exemptions can reduce taxable value for primary residences and can affect what you see on the bill.

- Was the home recently purchased or newly built? Reassessments can change the bill after a sale or as market values move.

“But schools are the biggest part, right?” Usually, yes

In many North Atlanta tax bills, school taxes are a major share. Georgia policy resources commonly describe the mechanics (assessment at 40% of market value, then millage applied) and note school system millage limits unless increased by referendum.

That’s why city limits aren’t the only variable—but they’re often the one buyers forget to verify. The strongest approach is to treat taxes as location + jurisdiction, not just county.

Compare your real tax range before you commit

Get a free Forsyth County property tax estimate

Property taxes in Forsyth County can vary by city limits, school district, and available exemptions. If you’re buying, owning, or investing, we can estimate a realistic tax range for the area you’re considering.

- No pressure, local insight

- Helpful for buyers, homeowners, and investors

- Clear expectations before you commit

Estimates are informational and not an official tax bill.

The Final Verdict

In North Atlanta, the county line matters—but the city line can matter just as much. Before you fall in love with a floor plan or a commute time, confirm whether the property is inside city limits and what that means for the tax districts applied to the parcel. Five minutes of verification can prevent years of budgeting surprises.

Related reading: How property taxes work in Forsyth County (2026) •

Forsyth vs. Fulton vs. Gwinnett property tax comparison (2026)